Reverse Exchanges

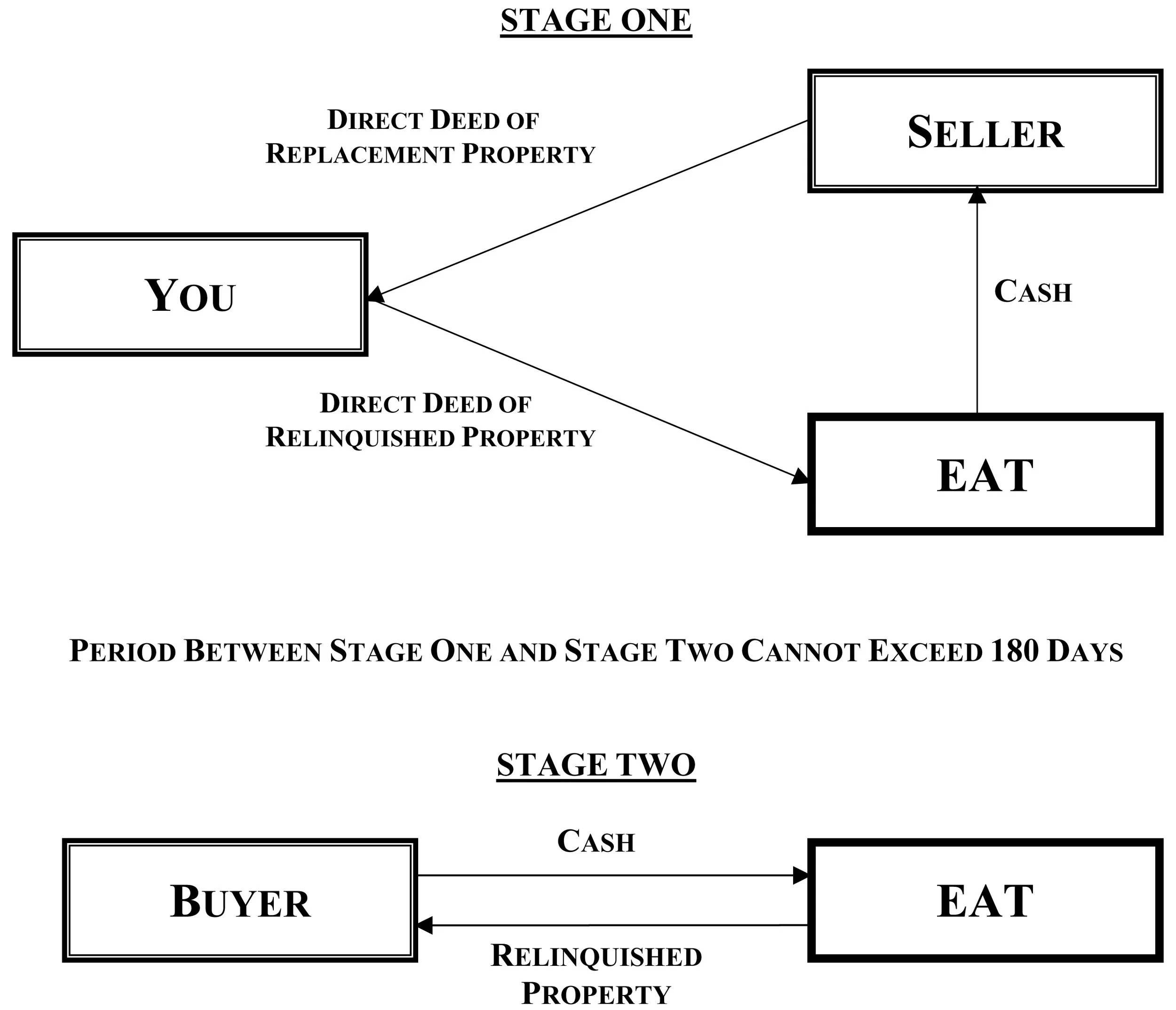

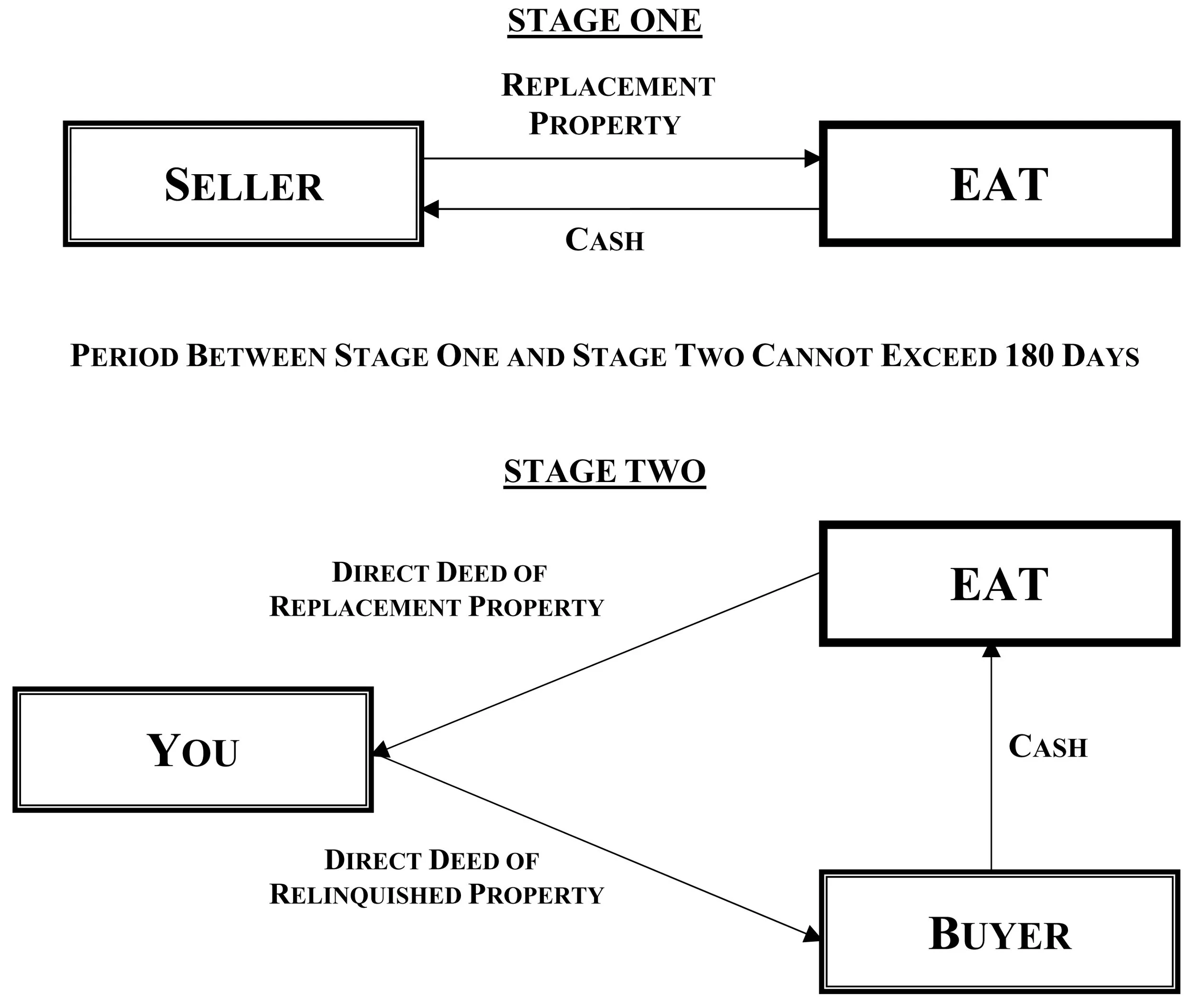

Reverse 1031 exchanges allow a real estate investor to purchase new Replacement Property before selling their existing Relinquished Property. This is the opposite chronology of a traditional/straight/forward 1031 exchange where the sale of the Relinquished Property occurs first. In a traditional exchange, the simple rule is that the real estate investor cannot touch the money; in a Reverse 1031 exchange, the simple rule is that the real estate investor cannot be on title to both the Relinquished Property and the Replacement Property at any moment in time. Thus, instead of the Qualified Intermediary holding in escrow the sales proceeds from the sale of the Relinquished Property, title to either the Replacement Property or the Relinquished Property must be vested in the Qualified Intermediary through what’s known as an Exchange Accommodation Titleholder entity for the duration of the exchange. This strategy is considerably more advanced but extremely useful when circumstances require an investor to secure a desirable new property before they are able to sell their current one.